As the banking landscape continues to evolve in the digital age, the future of banking is increasingly intertwined with online trading and investment opportunities. With the rise of online demat accounts, investors now have unprecedented access to Yes Bank share price movements and the ability to analyze and trade shares conveniently from their fingertips. Let’s delve into the future of banking by analyzing Yes Bank share price in the online sphere and exploring the implications for investors.

Table of Contents

Accessing Yes Bank Share Price with Online Demat Accounts

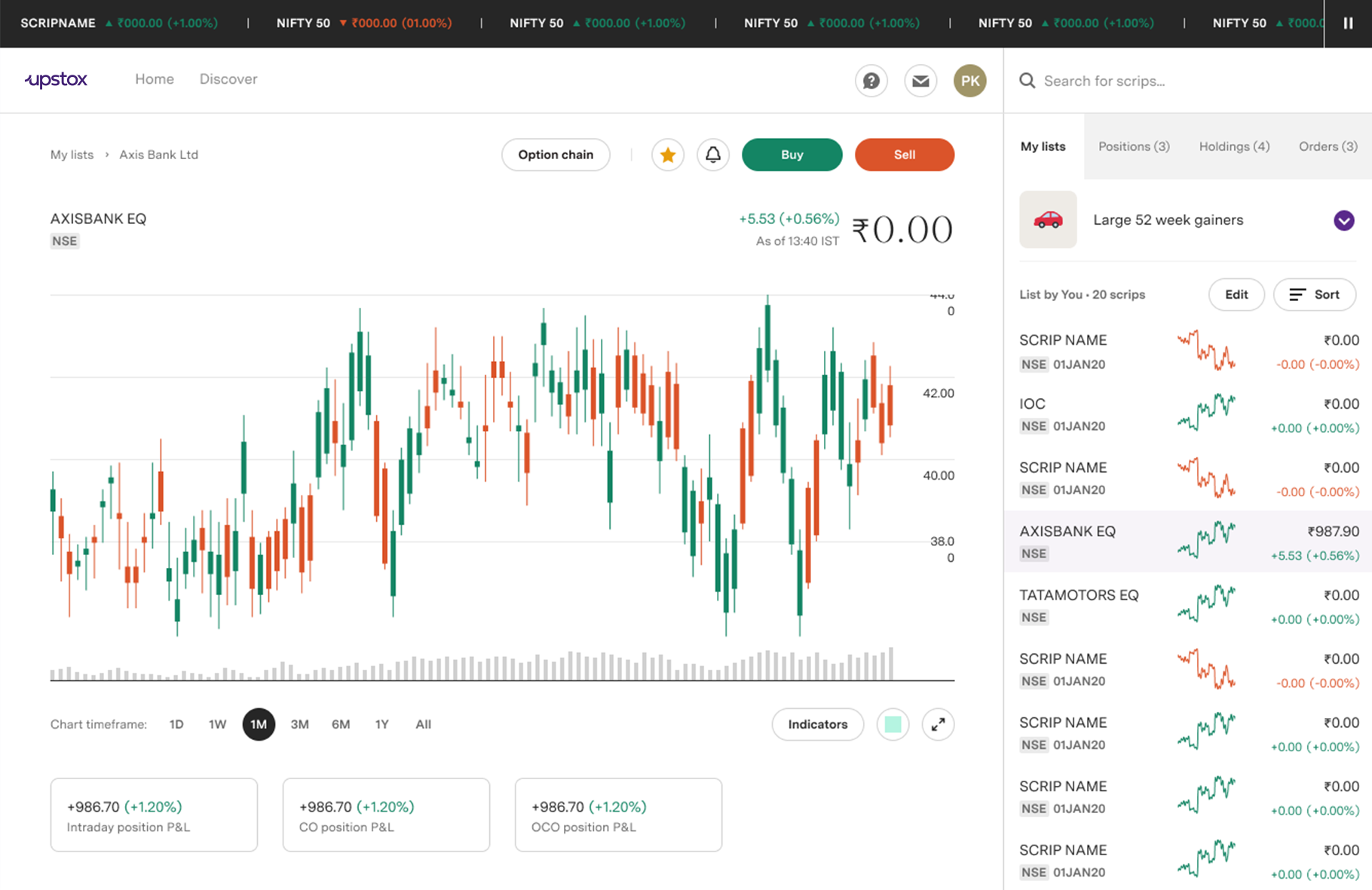

Online demat account have revolutionized the way investors access and interact with Yes Bank share price data. Through these digital platforms, investors can monitor Yes Bank share price movements in real-time, track historical trends, and analyze performance indicators with ease. The convenience of online demat accounts has democratized access to financial markets, allowing investors of all levels to participate in trading activities and capitalize on investment opportunities.

Harnessing Analytical Tools for Informed Decision-Making

In the online sphere, investors can leverage a myriad of analytical tools and resources to analyze Yes Bank share price trends and make informed investment decisions. From technical analysis indicators to fundamental research reports, online demat accounts offer a wealth of insights to guide investors in their trading strategies. By harnessing these analytical tools, investors can gain a deeper understanding of Yes Bank’s financial health, market positioning, and growth prospects, empowering them to make sound investment choices.

Navigating Market Volatility with Confidence

Market volatility is an inherent feature of the banking sector, and Yes Bank share price is no exception. However, with the advent of online demat accounts, investors can navigate market volatility with greater confidence and agility. Through real-time access to Yes Bank share price data and the ability to execute trades swiftly, investors can capitalize on market opportunities and mitigate risks effectively. By staying informed and disciplined in their approach, investors can weather market fluctuations and position themselves for long-term success.

Embracing Innovation and Digital Transformation

The future of banking is characterized by innovation and digital transformation, and online demat accounts are at the forefront of this evolution. As banks and financial institutions embrace technology to enhance customer experience and streamline operations, online trading platforms play a pivotal role in facilitating seamless access to financial markets. By embracing innovation and adapting to technological advancements, investors can stay ahead of the curve and capitalize on emerging opportunities in the banking sector, including fluctuations in Yes Bank share price.

Conclusion

In conclusion, the future of banking is intricately linked with the online sphere, where investors can analyze and trade Yes Bank shares with unprecedented convenience and efficiency. Through online demat accounts, investors have access to real-time Yes Bank share price data, analytical tools, and trading platforms that empower them to make informed investment decisions and navigate market volatility with confidence. By embracing innovation and digital transformation, investors can position themselves for success in the dynamic landscape of banking and capitalize on opportunities presented by Yes Bank share price movements.